DHL Hong Kong Air Trade Leading Index (DTI)

DHL Hong Kong Air Trade Leading Index ("DTI") is a quarterly survey implemented by the Hong Kong Productivity Council ("HKPC"), and commissioned by DHL Express (Hong Kong) Limited ("DHL").

DTI is the first-of-its-kind in Hong Kong, offering publicly available market intelligence for local enterprises, especially SMEs which typically have limited resources or access to information, enabling all to take reference from a comprehensive business review of the sector in which they operate.

The Overall Index represents the air trade market outlook for the surveying quarter, in respect of import and (re-)export. The research also studies the underlying trends in business attributes, markets and air-freighted commodities, thus assisting local enterprises in arriving at a primed view of the business outlook of their markets.

DTI – Second Quarter of 2024

Release Date: 18 Apr, 2024

REPORT SUMMARY

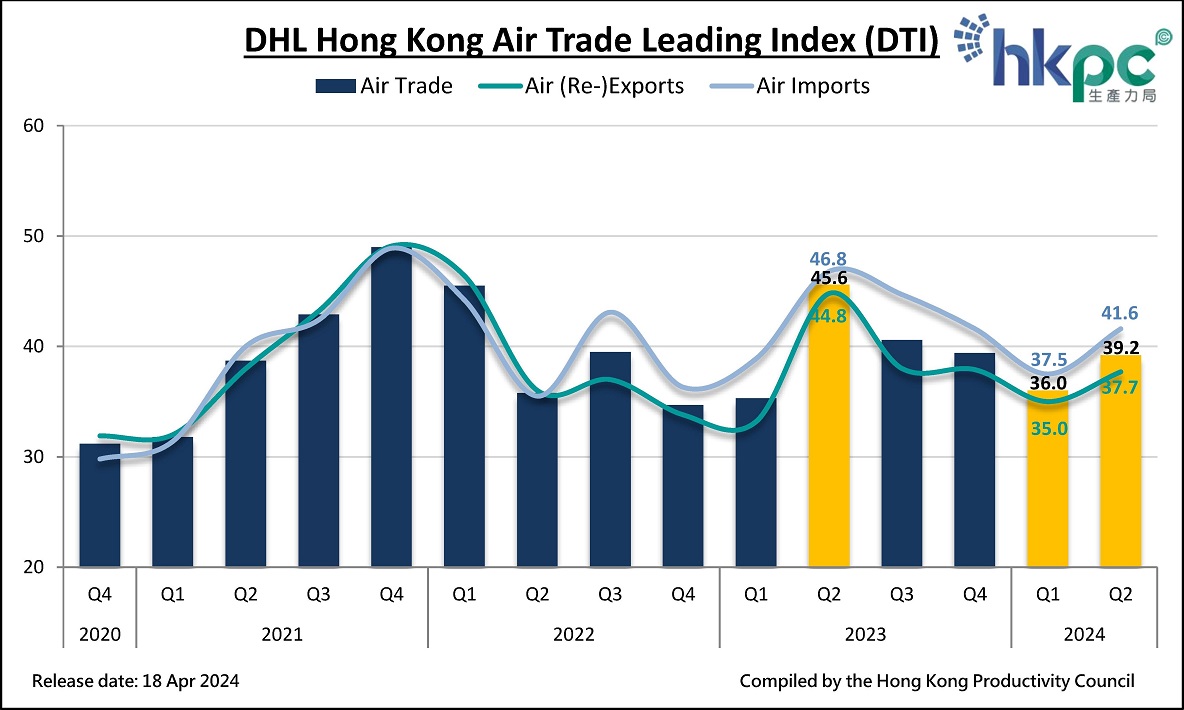

The Overall Air Trade Index forecasted a modest improvement in Q2 2024, halting a continuous decline observed since Q3 2023. In the meantime, around 40% of traders transitioned freight from ocean to air at varying levels in Q1 2024 in response to the ongoing Red Sea incident, and they expect this shipping arrangement to remain similar in Q2 2024.

- Overall Air Trade Index rose by 3.2 points to 39.2 points in Q2 2024, with both Air Imports and Air (Re-) Exports indices recording an upward trend, reading at 41.6 points and 37.7 points respectively.

- Air traders were more optimistic about Sales Volume which increased by 4 points to 40 points this quarter, while both Product Variety and Shipment Urgency remained stable.

- A significant decline (-3.9 points) in Online B2C business outlook was observed, heavily influenced by a decrease in Product Variety, which retreated by 4.3 points.

- Asia Pacific, Europe and Americas markets witnessed a recovery in their index performance in Q2 2024, especially in their Sales Volume. Despite the imminent Labour Day holiday and the 2024 Paris Olympics, only one-tenth of surveyed traders observed an increase in demand for air-freight goods.

- In light of Red Sea incident, around 40% of traders transitioned freight from sea to air in Q1 2024. A similar pattern of transition is also expected this quarter. Traders who did not transition from sea to air shipping in Q1 demonstrate behaviour changes in Q2, with a notable shift towards both the Europe and Americas markets.

- A growing number of air traders are expressing willingness to reduce carbon emission, reaching a peak level of 77% this quarter. Among these traders, over 90% are willing to allocate up to 10% of their logistical costs towards achieving this goal.

Mr Edmond Lai, Chief Digital Officer of HKPC, commented, “The Overall Air Trade Index improved by 3.2 points this quarter, reaching 39.2 points. However, it remains relatively weak due to uncertain economic factors. Only about 10% of air freight users expect increased demand during the upcoming Labor Day holiday and the Olympic Games Paris 2024. Air freight users should be prepared for long-term challenges caused by economic uncertainties. Despite the economic impact, over 75% of air freight users are willing to actively participating in carbon reduction initiatives. HKPC encourages businesses to review their operational processes for potential carbon footprint reductions. We will support sectors in establishing carbon reduction targets and adopting low-carbon technologies to promote industry-wide green transformation.”

Download the latest report of DTI (PDF version) (Text-only version).

Download of DTI Quarterly Report

Methodology

Index Calculation: Index = [100 x (Percentage of samples responding "Positive") ] + [50 x (Percentage of samples responding "Neutral") ] + [0 x (Percentage of samples responding "Negative") ]

Readings

- Ratios of collected responses are used to form the indices.

- An index value above 50 indicates an overall positive outlook while a reading below 50 represents an overall negative outlook for the surveyed quarter.

- The further the reading is from 50, the more positive or negative the outlook is.

Demographics

- Respondents are Hong Kong-based companies with either inbound or outbound air trade. It includes Watches, Clocks & Jewellery, Apparel & Clothing Accessories, Electronic Products & Parts, Gifts, Toys & Houseware, Food & Beverage and Others (including courier items and other items that do not belong to the categories listed above).

- Over 600 samples are collected in each quarter.

- Sample companies are randomly selected from publicly available directories.

Disclaimer

This report contains survey result based on research findings. HKPC will not be liable for any loss, mistake, delay, action or non-action by viewers of this report.

Enquiry

For more details about the Index, please contact HKPC at tel. (852) 2788 5306.

LANGUAGE

LANGUAGE

FOLLOW US

SUBSCRIBE TO OUR NEWSLETTERS

Share the latest information of HKPC to your inbox

SIGNUP NOW